The significant year-on-year improvements largely followed from the consolidation of ZA Puławy S.A. since January 18 2013, i.e. the acquisition date, which contributed a one-off gain on acquisition of PLN 446m, thus improving the financial performance.

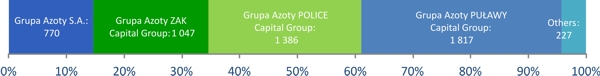

Structure of Grupa Azoty’s Consolidated Revenue

“In our core business, there was a strong 35% year-on-year increase in the Fertilizer segment’s revenue, mainly due to the consolidation of Puławy’s revenue. The economies of scale, supported by the continued stability of prices, especially on the markets for nitrogen fertilizers and intermediates, enabled us to achieve a higher EBITDA margin of 17%, up on 14% in the previous year,” said Andrzej Skolmowski, Vice-President of the Management Board in charge of Finance and IT.

The Chemicals segment, which comprises the former OXO segment, technical urea and melamine, reported an almost 81% year-on-year rise in revenue, mainly on the back of stronger melamine prices (the limited market supply in Q1 translated into an almost 32% price increase). This, however, had no positive effect on the EBITDA margin, which fell to 8%, from 11% in the previous year. The decline was mainly a result of weak demand, an adverse pricing environment in the OXO market (mainly plasticizers), and a 40% fall in sales, all of which led to the scaling back of production, higher unit fixed costs, and depressed margins.

In the Plastics and Pigments segment the trends seen in Q1 2013 continued. The persisting high prices of key raw materials (mostly oil derivatives in Plastics) and the continued strong price pressures in the key product groups had a significant adverse effect on the EBITDA margins, which shrank to -3% for Plastics (H1 2012: 15%), and to 0% for Pigments (H1 2012: 24%).

As part of implementation of the Grupa Azoty’s strategy, in H1 2013 the Group enjoyed a number of major successes in securing sources of raw materials and expanding its product range.

"In June 2013 we initialled a draft agreement with the State Treasury for acquisition of an 85% equity interest in Kopalnie i Zakłady Chemiczne Siarki „Siarkopol” S.A., a producer of sulphur – one of the basic raw materials used by Grupa Azoty. Grupa Azoty Police continue on-going negotiations with its Senegalese partner to secure supplies of phosphate rock for production of compound fertilizers, while Puławy placed a bid for Zakłady Chemiczne „Organika-Sarzyna,” a renowned manufacturer of plant protection products. These and other projects bring us closer to greater independence in terms of raw materials and come as an opportunity to build new competences in new areas," explained Krzysztof Jałosiński, Vice-President for strategy and development at Grupa Azoty and President of Grupa Azoty Police S.A.

"The past six months also saw a lot of capex activity. During the period, we completed a number of key projects, such as construction of a flue gas desulphurisation unit and an ATS (ammonium thiosulphate) plant at Grupa Azoty Puławy S.A. We are also involved in major energy and plant efficiency improvement projects," said Marian Rybak, Vice-President in charge of investments at Grupa Azoty and President of the Management Board of Grupa Azoty Puławy S.A.